Payments modernization:

US mid-tier banks

2023 annual survey

What is the US mid-tier bank survey?

The survey is an annual research report that looks at the payments modernization priorities of US mid-tier banks.

Commenced in the first quarter of 2023, the report was developed from interviews with over 70 senior banking, mid-tier financial institutions to glean insights into their current payment operations and shed light on their strategic plans for system modernization over the next 12 months.

The results are then compiled into the “US mid-tier bank survey,” aimed to capture the pulse of the industry, identify challenges, and understand emerging trends in payments. By providing insights aligned with market dynamics, our hope is to empower institutions to compete effectively and innovate alongside their larger counterparts.

What are leaders currently prioritizing?

43% indicated their intention to connect to the FedNow service within the next year, up from 29% in 2022

most requested capability among corporate clients is instant payments

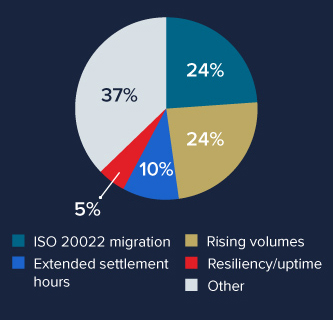

ISO 20022 migration has become a major concern for the wireroom

Over 7 out of 10 banks report the most wanted new payments capability is APIs

The results are in.

Additional highlights from this year’s survey.

In a dynamic financial landscape defined by rapid evolution, mid-tier financial institutions are tasked with an imperative: to remain ahead of the curve. The challenges voiced by respondents provide an encompassing view of the obstacles that lie ahead. This report serves as both a testament to the current situation and a compass for navigating the exciting path forward.

Highlights:

- 50% of institutions already have or are in the process of implementing a Payments as a Service model

- 47% of institutions in the process of acquiring an instant payments system are in the discovery and planning stage

- 24% of institutions indicated that rising wires volume continues to be a major concern

Fill out the form and download your copy today.