The U.S. payments ecosystem is undergoing a rapid transformation. In response to a rising demand for faster, safer, and more intuitive transactions across the board, financial institutions are increasingly looking to modernize their operations in a variety of ways, including through the adoption of real-time payments technology.

As part of our ongoing efforts to better understand how mid-tier banks and credit unions are approaching payments modernization, Volante surveyed payments professionals from 80 financial institutions in the first quarter of 2022 to learn more about the current state of their operations, as well as how they expect to adapt to the evolving ecosystem in the future.

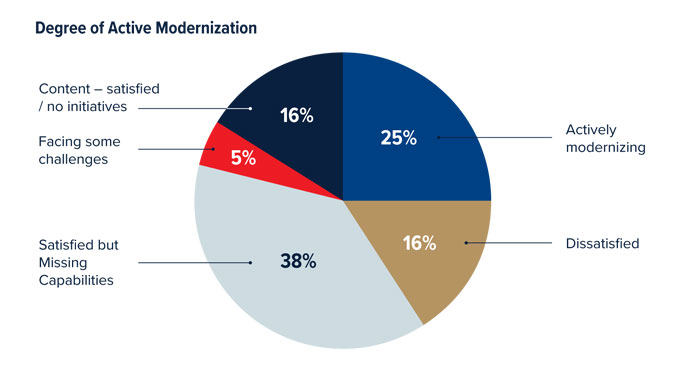

One Quarter of Mid-Tier Banks are Actively Modernizing

While 60% of respondents reported being satisfied with their current operations, and have no concrete modernization plans despite missing capabilities, 25% stated that they are actively modernizing operations and have at least one initiative planned. However modest this number may seem, it actually puts mid-tier financial institutions well above the classic technology diffusion curve, which normally predicts that around one in six market participants will emerge as early adopters or innovators in their respective industries.

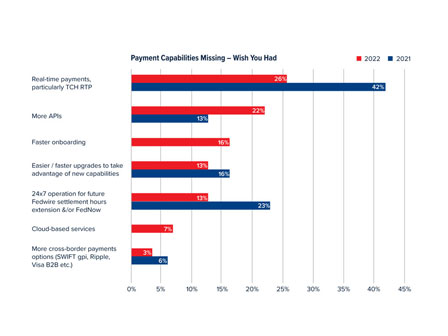

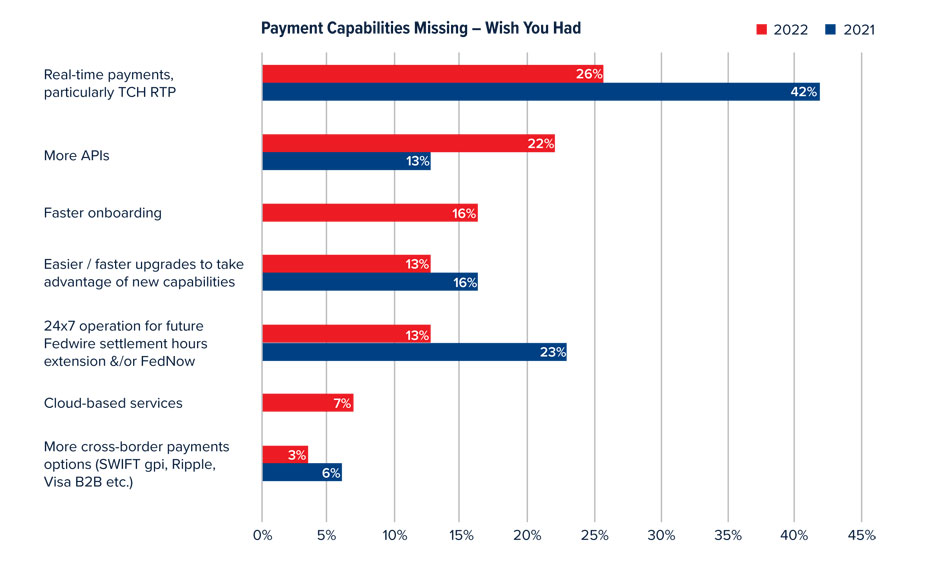

As to which modernization capability is the most desirable, real-time payments is again the most-cited answer for the second year in a row, with a 26% respondent rate. This is down from 42% in 2021, which is very likely a result of more FIs being onboarded to RTP over the past year. There was also a sizeable increase in respondents wanting to gain additional APIs, with 22% mentioning it this year vs. 13% last year. We conclude that larger financial institutions are rapidly acquiring API capabilities, which is putting pressure on the mid-tier FIs to do the same.

Overall, in addition to revealing some important trends and challenges, the results of our 2022 survey point to continued evolution in the payments operations of mid-tier banks. In the coming years, we expect to see novel capabilities, including the prevalence of real-time networks, to lead to increased competition and further modernization of the payments sector.

To get a more in-depth look at the state of payments modernization across US mid-tier institutions, download a complimentary copy of the full report here.