Is FedNow a CBDC — and what even is a CBDC in the first place?

As discussions around central bank digital currencies (CBDCs) continue to gain momentum, it’s important to address any confusion or misconceptions between CBDCs and payment systems, such as the Federal Reserve’s recently launched FedNow Service. In this article, we’ll explain what CBDCs are, how they differ from and relate to the FedNow Service, and how these innovations contribute to the evolving digital payments landscape.

- What Are Central Bank Digital Currencies?

- Are CBDCs a Cryptocurrency?

- The Rise of CBDCs

- What Is FedNow?

- FedNow vs. CBDCs: What’s the Difference?

- FedNow Challenges & Opportunities

- What Do CBDCs, FedNow & Digital Payments Signal for the Future of Payments?

What Are Central Bank Digital Currencies?

Central bank digital currencies, or CBDCs, are exactly what they sound like: a digital form of currency issued and regulated by a country’s central bank and backed by its government. The value of a CBDC is tied to the value of the fiat currency issued by that central bank, meaning it typically has a one-to-one conversion rate.

There are two primary types of CBDC:

- General-purpose CBDCs are designed to be used by the general public and businesses and have the same value and legal status as a country’s fiat currency. General-purpose CBDCs can be used for a range of everyday transactions, such as the purchase of goods and services, peer-to-peer payments, and online transactions.

- Wholesale CBDCs are primarily intended for use in wholesale financial markets and for transactions between financial institutions. Wholesale CBDCs can be used for interbank settlements, large-value transactions, and other financial market activities.

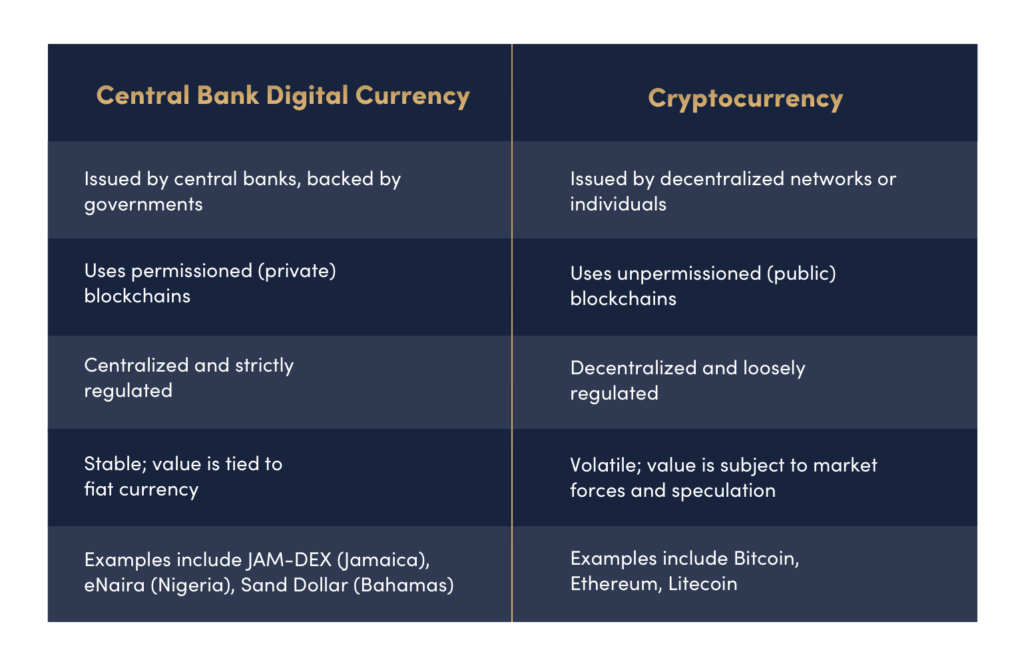

Are CBDCs a Cryptocurrency?

Although CBDCs are a form of digital currency, they are not a cryptocurrency. Compared to cryptocurrencies, CBDCs are centralized, meaning they’re issued and regulated by a monetary authority — in this case, a country’s government. They’re also considered legal tender and hold the same status as any traditional fiat currency issued by a central bank. Finally, by virtue of the fact that CBDCs are based on fiat currency, they’re far less volatile than cryptocurrencies, whose value is determined by market forces and speculative activity.

While both CBDCs and cryptocurrencies have their advantages and disadvantages, the general consensus is that they are two very different things, with different implications for the economy and society at large.

The Rise of CBDCs

Cryptocurrencies and other decentralized, blockchain-based forms of payment continue to gain traction for a variety of reasons, including their ability to:

- Protect private funds from oppressive governments and corrupt systems

- Send aid directly to marginalized groups through a secure money transfer

- Introduce reliable digital payment options in regions without existing systems or trust in government

The decentralized nature of cryptocurrencies has also accelerated innovation in cross-border payments — for example, Ripple, a real-time gross settlement system, has successfully built a global payment ecosystem with the XRP cryptocurrency at its core.

The growing popularity of cryptocurrencies has created increased competition for central banks, which have realized that they need to offer instant, electronic payments to stay current and maintain market share.

For all their benefits, cryptocurrencies also pose risks: Due to their decentralized and unregulated nature, cryptocurrencies can be exploited for money laundering, terrorist financing, and other illicit activities. CBDCs make it possible for citizens to use digital currencies to conduct lawful business without having to purchase speculative vehicles.

CBDCs not only benefit consumers but central banks, too. With increased traceability comes reduced risk of money laundering, fraudulent activity, tax evasion, and under-the-table transactions, enabling central banks to better maintain compliance with anti-money laundering (AML) and know your customer (KYC) requirements.

CBDCs enable central banks to compete with private-sector offerings by providing a wider array of services to consumers, including a more stable, secure alternative to cryptocurrencies. There’s also a cost-saving incentive to CBDCs, as electronic payments are less expensive to process — both for governments and financial institutions — than paper-based payments.

It’s important to note that while CBDCs offer a great many benefits, they also have perceived downsides. Some parties have expressed concern that, because CBDCs are centrally controlled, they could lead to increased government oversight and erode citizens’ right to privacy. It’s worth noting that some of the earliest implementations of CBDCs have been in jurisdictions where individual privacy rights are not strongly protected.

What Is FedNow?

The FedNow Service is a real-time gross settlement system developed by the Federal Reserve, the central bank of the U.S. government. FedNow aims to increase the speed and convenience of a wide variety of transactions, including peer-to-peer payments, business-to-business payments, and bill payments, while reducing reliance on traditional payment methods, such as paper checks and Automated Clearing House transactions.

Launched in July 2023, FedNow is the culmination of a years-long effort to address industry gaps and modernize the U.S. payments system. The FedNow Service leverages the ISO 20022 messaging standard, providing any financial institution connected to the network with standardized and enriched data, improving interoperability and straight-through processing, and increasing payments efficiency.

While FedNow is not the first instant payment system in the U.S. — The Clearing House predates it by several years — it is the first of its kind to be offered by the Federal Reserve and is expected to further accelerate the adoption of real-time payments.

FedNow vs. CBDCs: What’s the Difference?

There’s been some confusion recently around the relationship between FedNow and CBDCs, with some wondering whether FedNow is a CBDC. To cut right to the chase: No, it is not, and the two are fundamentally different. CBDCs are not a payment mechanism, but rather a form of currency and a digital means of storing value. FedNow, however, is a payment mechanism — in other words, it’s a means of moving funds from one bank account to another.

To put things into perspective, the FedNow Service can be likened to a highway system, providing a fast and efficient infrastructure for the movement of payments between financial institutions. Just as there are many types of vehicles that can operate on this highway, there are many types of payment messages that can be sent through the FedNow Service. In this analogy, the passengers within these vehicles represent the stored value of CBDCs and other forms of currency, as well as extended payment data elements such as invoices and electronic check stub details, traveling along the FedNow highway from one location to another.

FedNow Challenges & Opportunities

The one thing that FedNow and CBDCs do have in common is that they both pose technology challenges. Financial institutions can easily sign up to join the FedNow network, but they still require the underlying technology to actually support it.

At present, most financial institutions continue to rely on legacy technology for payment processing, which has made adopting real-time payments, application programming interfaces (APIs), and the ISO 20022 standard difficult. Legacy technology also struggles with the leap to 24×7 non-stop operation, which is an essential requirement of instant payment systems such as FedNow.

Many institutions are reluctant to update or replace those systems unless absolutely necessary, for fear of service disruption; many core system providers are also slow to update or innovate their solutions. In order to use FedNow, and to continuously drive payment innovation, central banks must divest themselves of legacy systems and embrace payments modernization.

Payments modernization offers financial institutions a path forward, enabling them to take full advantage of both the FedNow Service and CBDCs — but legacy systems aren’t the only challenge they face. Even if a financial institution is able to connect to FedNow, it still needs to differentiate its services from those of its competitors.

For example, although PayPal and Venmo both offer the same basic service — a fast and efficient means of sending and receiving money, including CBDCs — both platforms have developed unique feature sets to differentiate themselves, from making it easier for users to split payments and adding a social component to offering payment services for businesses.

To compete in today’s increasingly crowded payments industry, financial institutions will need to create value-added services to distinguish themselves from other institutions connected to the FedNow Service; customer experience and the Request to Pay mechanism, which enables customers to unify bill presentment and payment, will both play a key role in this. Those that succeed in doing so will be able to take advantage of data-rich messaging formats — FedNow leverages the ISO 20022 messaging standard — and streamline payments reconciliation.

What Do CBDCs, FedNow & Digital Payments Signal for the Future of Payments?

Looking to the future, FedNow, digital payments, ISO 20022, and CBDCs will be transformational not only for businesses within the financial services industry but for anyone who uses financial services. In the long run, they will coexist with cryptocurrencies, providing consumers and businesses with a wide range of complementary mechanisms for the digital transfer of value.

They’ll play a critical role in facilitating simple, streamlined transactions, enhancing traceability to disincentivize crime, and ensuring that transactions are appropriately taxed and tariffed, to the benefit of local and global economies. These innovations will also make formalized financial services accessible to a broader audience, including unbanked and underbanked populations, which have historically had to rely on usurious services.

Although some parties may be skeptical of FedNow and CBDCs, arguing that digital currencies and payment infrastructures should not be the purview of the government, they’ll help to make legal transactions fast, frictionless, and data-rich, thereby reducing the risk of illegal transactions, which come at a serious cost to both individuals and economies.

Ultimately, the evolution of FedNow and CBDCs will drive a greater need for payments modernization — and Volante Technologies can help. Our cloud-native payments as a service solutions and low-code financial platform provide financial institutions with the means to rapidly innovate and capitalize on CBDCs, FedNow, and other emerging trends.

Contact us today to learn more about how we can support you.

How Will ISO 20022, FedNow, and CBDCs Transform U.S. Payments?

Get expert insights from thought leaders from Volante Technologies, the Federal Reserve, KPMG, and more in this on-demand webinar.