The introduction of FedNow in July 2023 is the latest milestone in the U.S. banking industry’s journey toward faster payments. It’s hard-won progress, as banks have faced considerable challenges when transforming business operations to accommodate a 24/7 model while safeguarding against real-time fraud vulnerabilities.

To better understand the complex factors driving this transformation and the shifting dynamics of payments in the U.S., Volante has sponsored an annual survey of 427 market participants — including financial institutions, facilitators, and network operators — on which this report is based. As the industry propels forward and embraces real-time payments, this report underscores the critical importance of strategic planning and forward-thinking, the challenges inherent to legacy systems and the need for collaboration with trusted partners.

Between this week and next, we will share data highlights from this report.

The industry is headed in the right direction

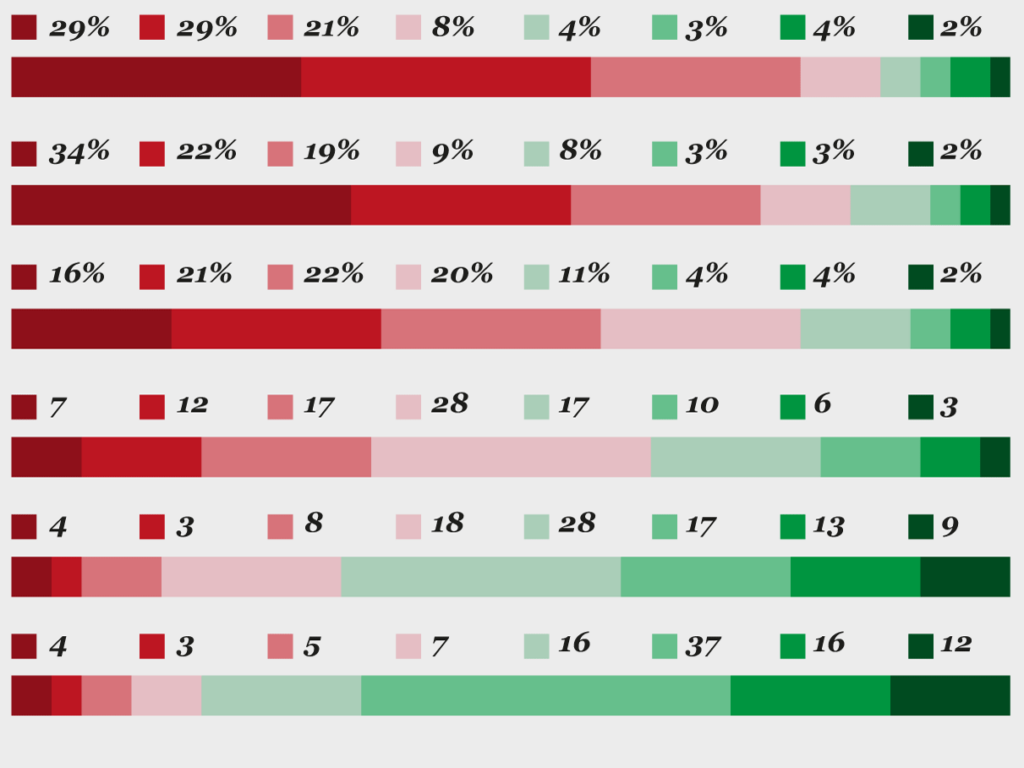

This year’s survey recorded the highest level of satisfaction towards faster payments adoption, at an average of 51%. Financial institutions (FIs) were the most satisfied at 61%, while businesses were the least satisfied at just 31%.

61% of financial institutions said that they are satisfied with the industry’s progress towards faster payments adoption.

Organizations across all industries show a real interest in faster payments, with 78% of respondents across all industry segments saying that faster payments are a “must-have” for their organization. It’s noteworthy, though, that this figure is 6% lower than it was in 2021; businesses, in particular, were more likely to say that faster payments are not a “must-have” than other respondents.

“This is an indicator that we haven’t proven our value proposition completely,” said Elizabeth McQuerry, partner at Glenbrook Partners — the payments consulting firm behind the Barometer — during an FPC Town Hall. “This could, potentially, become a vicious cycle. If enough businesses don’t want to offer [faster payments], then we’ll have fewer FIs who consider them a ‘must have’.”

For those who did say that faster payments are a “must have,” consumer payments proved to be the driving force behind their interest. Survey respondents ranked consumer bill pay, peer-to-peer payments and invoicing/supplier payments as top use cases for this technology.

Source: 4th Annual U.S. Faster Payments Barometer, June 2023

An impressive 80% of respondents reported that they either currently use or plan to use RTP® from the Clearing House, and 69% said that they plan to use FedNow®. Of that number, 80% of respondents plan to implement RTP or FedNow within the next 1–2 years, while 20% plan to implement it within the next 3–5 years.

Faster payments adoption isn’t the only thing on the rise — many organizations are also reconsidering their deployment strategies, with attention to send-and-receive services. For RTP, 84% of FIs say they will support send and receive services either initially (50%) or will add send eventually (34%).

92% of financial institutions will deploy a send-and-receive strategy for FedNow.

Expectations for FedNow are much higher, with 92% of saying they’ll support send and receive services either initially (44%) or will add send eventually (48%). The adoption of send-and-receive services for FedNow is significantly higher in 2023 than they were for RTP when it was first introduced in 2017.

Source: 4th Annual U.S. Faster Payments Barometer, June 2023

FPC Town Hall attendees expressed surprise at these figures — particularly, at the high send and receive distributions, despite this generally being considered a higher-risk path.

“That’s a great observation,” said McQuerry. “If we go back and look at the size of the organizations that responded, we’d most likely find that it’s the larger FIs that gave this response. […] But we have to think that people who responded to the Barometer, or those who really care about this, are on the cutting edge.”

Randy Rodriguez, the North American regional sales leader for Volante, agreed with this statement but noted that the evidence to support it was largely anecdotal.

“There are institutions that may have a specific type of client with a specific use case, where they want that specialization,” said Rodriguez. “And there are other institutions that simply see innovation as a differentiator and want to be first in their market. They see it as the tip of the branding spear and how they want to be perceived.”

Though expectations for these two networks may vary, both have strong overall support from FIs. And though it’s still early days for FedNow — with organizations still assessing its capabilities, impact on operations, and profit potential — the survey results suggest that it will have greater participation in send and receive capabilities long-term than RTP.

Interoperability continues to be a top concern

Interoperability is a chief concern for both FIs and businesses, with 71% of respondents considering it to be “very important,” and 21% seeing it as “somewhat important.”

Interoperability is the #1 challenge financial institutions face when adopting faster payments.

Source: 4th Annual U.S. Faster Payments Barometer, June 2023

The percentage of respondents who said that interoperability is “somewhat important” dropped slightly this year, which McQuerry suggested could be the result of aggregators and payment hubs entering the market. McQuerry noted that these aggregators and payment hubs provide technical workarounds for interoperability that ease the burden for FIs to connect with both the RTP and FedNow networks.

Looking back to the results, 57% of respondents cite interoperability as an ongoing issue for their organization. Faster payment schemes need to be interoperable and ubiquitous to scale volume and generate operational efficiencies — a challenge FIs are addressing by partnering with service providers that offer payments-as-a-service (PaaS) capabilities.

Approximately one-quarter of FIs and businesses also mentioned “insufficient organizational buy-in” as a top challenge, though this number has declined over the past four years.

But that’s where the similarities between these two groups end:

- 59% of FIs are concerned about high upfront implementation costs, compared to just 33% of businesses

- 40% of FIs see “insufficient readiness to manage risks in a real-time environment” as a major issue, compared to only 10% of businesses

- 42% of businesses see a “lack of common rules and standards” as a major concern, compared to 26% of FIs

Source: 4th Annual U.S. Faster Payments Barometer, June 2023

Andrew Lang, Managing Partner at Glenbrook Partners, reflected on how high costs, in particular, could become a barrier to entry for smaller FIs.

“Switching from an older payment network to a faster payment rail like RTP or FedNow requires a significant investment,” said Lang. “The biggest FIs are able to invest resources into these projects, but smaller FIs, such as credit unions, don’t have the necessary resources to transition. So, how do we make sure that faster payments is an inclusive network? Because that’s really important, especially for adoption.”

Lang noted that these financial barriers — in addition to a lack of common rules and standards — could impact interoperability.

To see additional results from the 4th Annual U.S. Faster Payments Barometer, download the whitepaper here.