Key trends shaping global priorities & investments in new payments solutions

With banks continuing to navigate an increasingly complex and dynamic payments ecosystem, as well as a historically uncertain macroeconomic and geopolitical landscape, Volante remains committed to tracking and understanding the rapidly evolving capabilities and priorities of financial institutions through the annual “Big Survey”, developed in collaboration with Finextra, on payments modernization. Based on 300 full responses from a combination of C-level executives and senior management directors at institutions from around the world, this year’s results paint the picture of a global financial services sector more insistent on transformation than ever before.

In our last blog, we highlighted some of the key trends surrounding the current state of capabilities and implementation plans, revealing an increased emphasis among banks toward more flexible, strategic utilization of emergent real-time payment rails, as well as a dramatic uptick in both the integration of cloud-based services and reliance on third-party Payments-as-a-Service (PaaS) providers to ensure the successful implementation of new solutions. Today, we’ll build on those insights by exploring what our survey reveals about the underlying causes behind these recent activities, including notable trends surrounding customer pain points and additional factors driving increased investment in payments modernization.

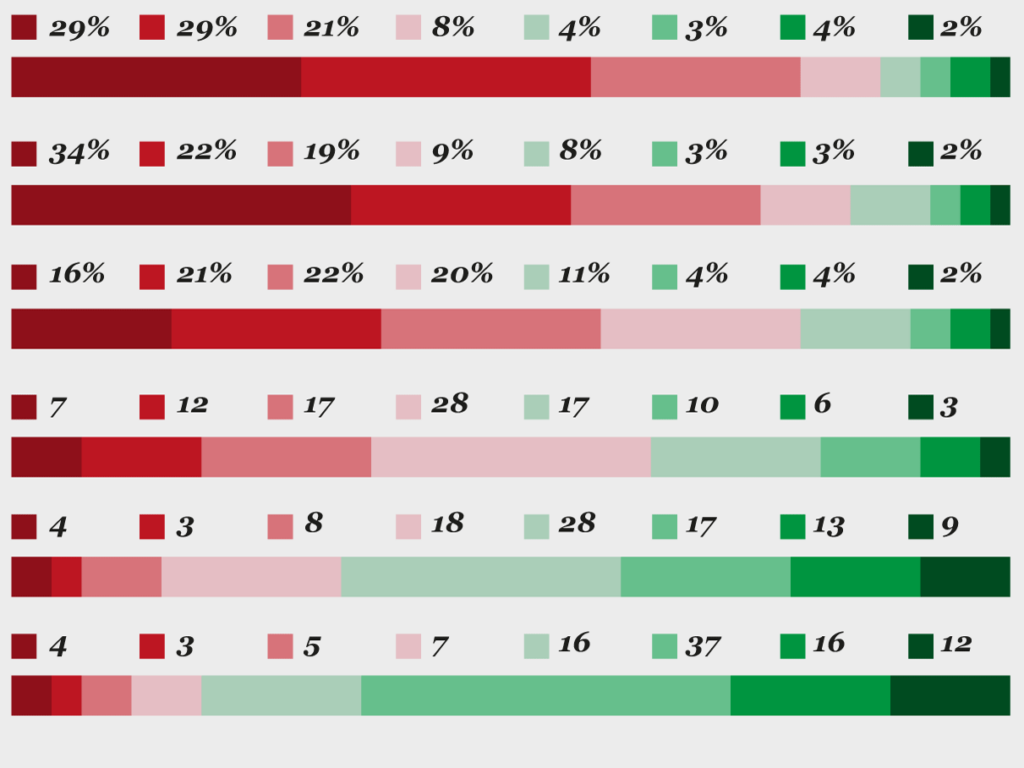

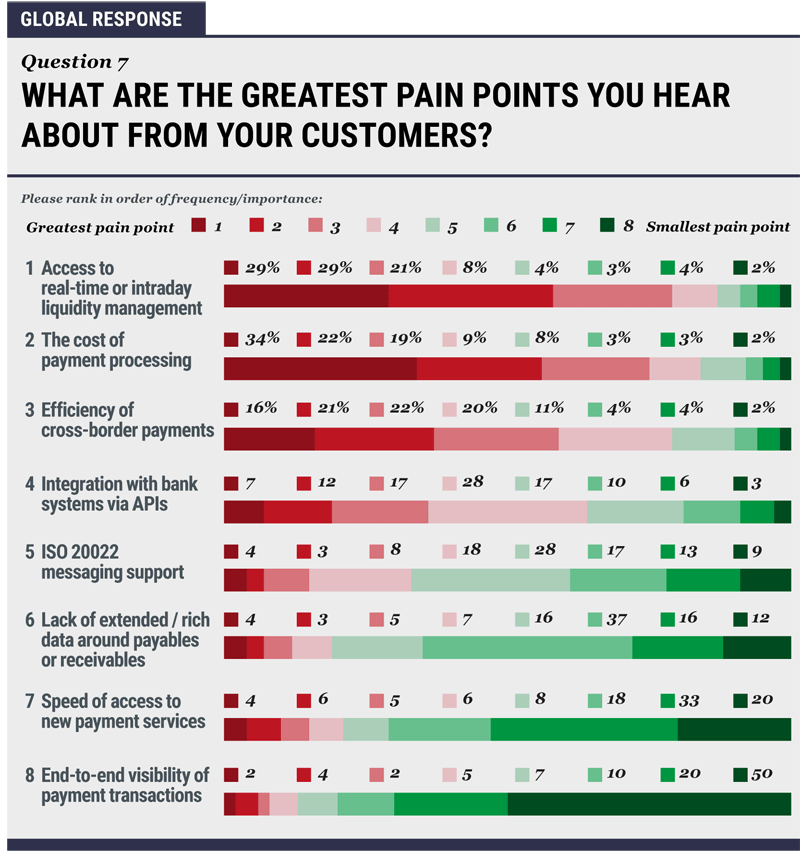

Top two customer pain points: Access to intra-day liquidity management & high processing costs remain

When asked about the greatest pain points they hear about from customers, access to real-time or intraday liquidity emerged as the top response globally (79%), followed closely by the cost of payment processing (75%). This represents a slight but notable shift in service delivery from last year when cost outranked access to liquidity by a small margin of 2%.

This increased emphasis on real-time connectivity may be indicative of progress already made toward lowering costs as the result of completed projects. In fact, last year’s survey saw nearly half of respondents (49%) either agree or strongly agree that they had made a return on investments in new payments solutions over the previous two years. If this trajectory of progress continues, we can only expect to see a significant reconfiguration and softening of major pain points in the years to come.

It’s also worth noting that while the order of pain points remains otherwise unchanged from 2022, we did find that some are being more keenly felt than in the previous year. For example, 37% of this year’s respondents strongly agreed that ‘efficiency of cross-border payments’ was a major pain point, a nearly ten percent increase from last year’s result of 28%. This change aligns with both the overall heightened expectations and requirements around the utilization of international payment rails, as well as the growing interest and confident use of cross-border options beyond the SWIFT network.

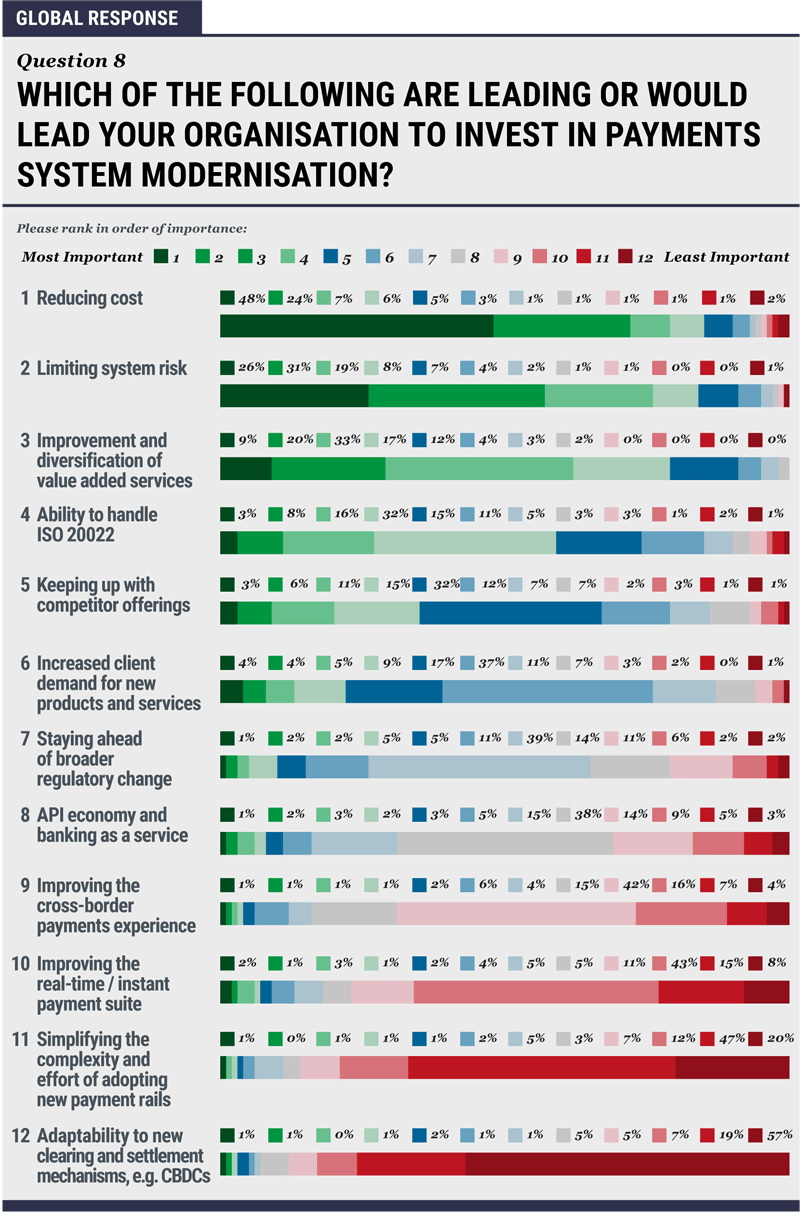

Beyond reducing costs, limiting system risk emerges as a top driver for investment

As far as what’s driving specific investments in payments modernization, reducing cost once again emerged as the top response both globally and in Europe, which may be viewed as both a reflection of customer demands as detailed above, as well as the overall effectiveness of emergent cloud-based payments solutions when it comes to lowering processing costs.

However, with the recently proliferated use of cloud-based infrastructure, in addition to increased reliance on outside services and PaaS providers, comes a renewed awareness of and commitment to overall system resilience. This is likely why we’ve suddenly seen ‘limiting system risk’ emerge as the second greatest driver for investment globally and in Europe, as well as climbing to the number one spot for North America.

To put this upward trend in perspective, this option ranked in only fifth place last year among European respondents, whose previous second place option of ‘improvement and diversification of value-added services’ has fallen this year to a mere 7%. Moreover, the rising perceived importance of limiting system risk globally is reflected in its comfortable dominance alongside cost reduction when compared with the remaining options, all of which garnered a “most important” rank of less than 10%.

Budget allocations are increasing considerably to accommodate payments modernization

Finally, we are heartened to observe an overall increased urgency and prioritization of payments modernization efforts across the board, as reflected in reported budget allocations for 2023. More specifically, 72% of respondents globally said their budgets will increase to accommodate the deployment of new technology or the significant upgrade of existing systems, whereas only 1% reported a decrease. These results only deviate slightly when zeroing in on North American and European respondents, 79% and 64% of which also reported an increase, respectively.

Overall, whether it’s improving and diversifying connectivity to domestic, intra-regional, and cross-border networks, or the broader implementation of emergent cloud-based payment solutions, this year’s survey has clearly revealed a stronger commitment than ever among financial institutions to accelerating payments transformation, as well as an undeniable resilience in the face of increasingly complex and unpredictable macroeconomic challenges.

Interested in learning more about the current state of payments modernization? Click here to download your complimentary copy of this year’s survey and explore the results and corresponding insights in their entirety.